Multiple Position Analysis

We often have more than one position on a particular Stock/ETF, so how can each position, or leg be evaluated?

Position Notifications

When you Enable and Activate Account Notifications, you’ll receive emails on upcoming activity that may affect your existing positions.

- Upcoming Earnings – Monday Morning via Email

- Upcoming Dividends – Monday Morning via Email

- Option Position Expiring – Two days prior via Email

To begin, locate and click on the Envelope Icon at the top of the platform page, next to your Username:

![]()

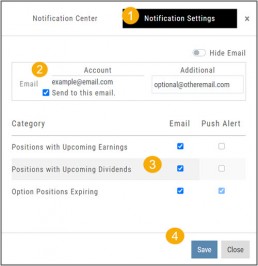

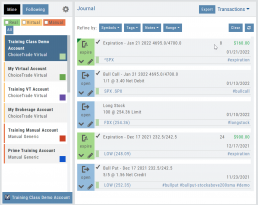

Follow the steps as outlined and illustrated:

- Click on Notification Settings

- Add your email (Optional: Add 2nd email)

- Check/uncheck Categories

- Click “Save”

The settings can be updated at anytime by following the above steps.

Next:

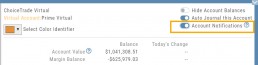

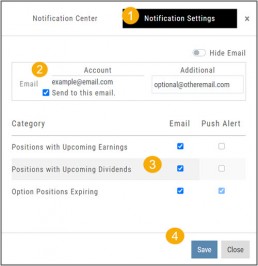

For each account you want to receive notifications on, toggle the switch located on the Account Summary tab to the “On” position as shown in the graphic.

**Without this step, you won’t receive the notifications.**

Expiration Notifications will be emailed 2 days in advance.

Each Monday, prior to Market Open, an email will be sent where there’s an Earnings or Dividend for any of the positions in the account(s) you have activated.

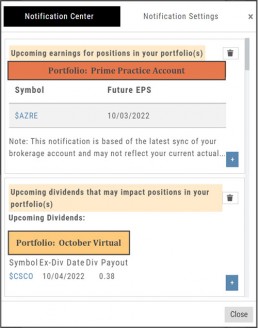

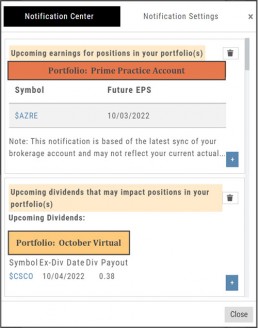

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

Platform Features Release: December 2022

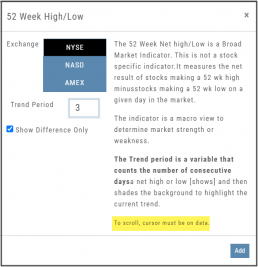

Announcing the latest Release which added a powerful Lower Indicator on the Charts Tab: 52 Week Hi/Lo. Price/Date info has been added to X/Y axis

52-Week Hi/Low Indicator

The newest lower indicator: 52-week Hi/Low Indicator is a Broad Market Indicator. It is not Stock specific.

View how individual Stocks/ETFs are faring compared to the Broad Market.

Select from NYSE, NASD or AmEx

There are two views:

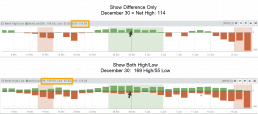

Show Difference Only – Display either a green or red (or no) bar representing the net advancers/decliners for that period.

Show High & Low (uncheck box)– Displays both green/red bars to illustrate number with new 52 week high/lows.

The background color identifies a bullish or bearish trend, based upon the number of days selected (Trend Period)

Example: If 3 days are selected, background highlight will begin on the 4th consecutive day of gains (or losses).

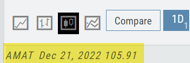

X/Y axis – Price/Date display

The cursor’s crosshairs will display the Price/Date info along the X/Y axis for easier reading.

This information will still appear in the upper/right corner above the chart:

Drawing Key Activation

Use your keypad to activate drawing lines on the Chart by following these steps:

1. Click either in Header area above the chart – OR –

Click the Annotation icon>Line

2. Click on chart, then “Alt” and “T” keys where you want to start line.

Once activated from either of the starting points (1), the function works on the current chart, without having to reactivate by clicking on the Header or Annotation icon.

Platform Features Release: November 2022

Announcing the latest Release allowing for customized Watchlist views. Improvements in Journal functionality will increase responsiveness and allow users to better control the data displayed. Format enhancements were also made to increase readability

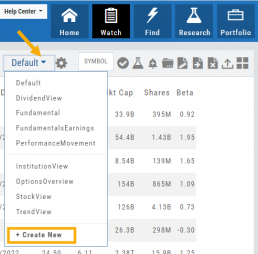

Watchlist Views – Create, Save & Edit

The ability to create your own Watchlist views based on criteria important to you enhances the work flow of finding the best candidates for trading.

Click on ![]() next to the (Default) Watchlist, then select “Add New” to get started.

next to the (Default) Watchlist, then select “Add New” to get started.

Build your own views from over 160 data points, then adjust the display position in the order you want them to appear.

Click on ![]() icon to edit a view you previously created.

icon to edit a view you previously created.

Learn more by clicking below:

Improvements

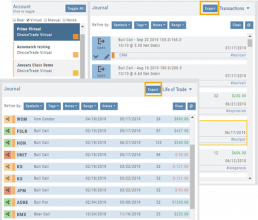

The Journal default displays Order/Trade activity from the Activated Trade Account.

To switch or add accounts, simply click on the other Account tabs or select by group: Real, Virtual, Manual or All accounts.

The improved functionality allows for faster journal activity display and easier trade analysis.

Change Log

- Resolved Score Icon Navigation from Home/Market Tab

- Corrected Fundamental/Dividend missing data

- Moving Average indicator functionality restored on Custom Page

- Corrected display data on Fundamental Tab

- Addressed candlestick not appearing first 20 minutes on Mondays.

- Rectified downloading data from Screener

Platform Features Release: October 2022

Announcing the latest Release of feature and functionality enhancements to the trading platform. These features and enhancements help keep users informed with activity on their trades. Functionality has been added to review a Watchlist in the Research tab, while being able to see at a glance which symbols have a price increase or decrease.

Notifications – Receive emails on upcoming Earnings, Dividends or Expiring Positions

Watchlist Research Functionality – Access and view your Watch Lists in the Research Tab via a drop-down box

Price Action Arrows on Symbols in Research Tab – Instantly see latest price action while on the Research Tab

Trade Position Notifications – Premium Feature

Want to receive weekly emails of Expiring Positions, Upcoming Earnings and/or Dividends on existing trades you have in your accounts?

This Premium Feature allows you to do just that in a 2-part process:

First: Click on the the Envelope Icon at the top of the platform screen:

![]()

Go to “Notification Settings.”

Provide your email address(es).

Select Notifications you want to receive.

Click “Save”.

Next: On your Portfolio Accounts, go to the Account Summary Page and Toggle the switch to the On position.

Repeat this process for each Account you want emailed Notifications.

Expiration Notifications will be emailed 2 days in advance.

Each Monday, prior to Market Open, an email will be sent where there’s an Earnings or Dividend for any of the positions in the account(s) you have activated.

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

Each Monday, prior to Market Open, an email will be sent where there’s Earnings or Dividend for any of the positions in the account(s) you have activated.

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

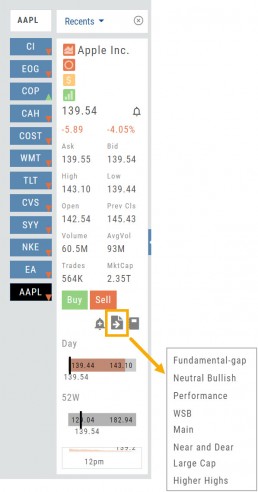

Research Watchlist Functionality

Users are able to access all Watchlists from the Research Tab.

Click the ![]() to access the dropdown list as shown in the graphic.

to access the dropdown list as shown in the graphic.

Lists with more than 20 symbols will have a scroll bar allowing for easier research of larger lists.

All other functionality remains the same: Symbols can be moved to other lists, have alerts set, deleted, add Journal notes

When a symbol is entered in the Symbol Search Box on the Research Tab, the symbol will automatically be displayed on the default “Recents” list.

In addition, when a symbol or group of symbols is sent to Research from anywhere else on the platform, it will appear on a list under the default “Recents” list.

Examples of when the “Recents” list will be displayed:

- Sending a symbol/symbols from a list on a Watch Tab.

- Selecting a group of symbols from a Scan or Screener list.

- Clicking on the Technical Icon from any symbol when not in the Research Tab. will be displayed under “Recents”.

The functionality of adding a note, an alert or sending a symbol to a specific list remains the same.

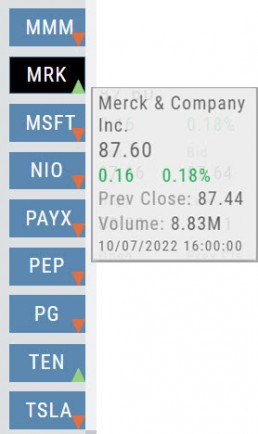

Green and Red Arrows have been added to each symbol tab when in Research.

This applies to any selected Watchlist or the default “Recents” list.

Each time one symbol is clicked, the entire list will update the latest price update.

Change Log

- Upper Indicator responsiveness corrected

- Profitability info loads correctly on Fundamental Tab

- Completed Bear Put description on Strategy Template

- Corrected display data on Fundamental Tab

Export Reports (Desktop)

Clicking on ![]() located on the upper left corner of the Positions and Gains tabs allows you to export that information as a .csv file.

located on the upper left corner of the Positions and Gains tabs allows you to export that information as a .csv file.

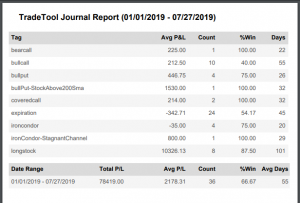

The Journal give you the ability to export reports in a PDF file on your desktop platform. But that’s just the beginning.

You can export from the Transaction or Reconciliation view filtered by Account, Symbol, Tags, Notes and/or Date Range.

Life of Trade View also allows you to filter by Order Status in addition to the above criteria for even more focused report. Only want to print Closed Trades? Want to see how many trades are Unmatched? Select those filters.

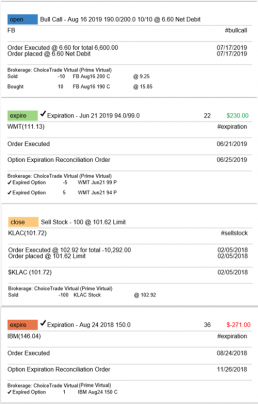

The top of your Journal report displays the Tag Summary based upon the account(s) and filtering criteria selected.

The trade detail report displays the status, Open, Close, Expire with a color code of the trade: Blue=Open, Green=Profit, Red=Loss, Yellow=Unmatched.

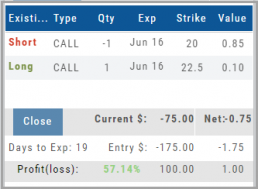

Evaluate Existing Positions

Positions will automatically show on the options chain for the active brokerage account.

You can also access directly from Broker Positions. Select “Analyze” from the Action menu.

This will display the current values as well as entry cost and current P/L.

Here you can also close the position or evaluate adjustments on the trade.

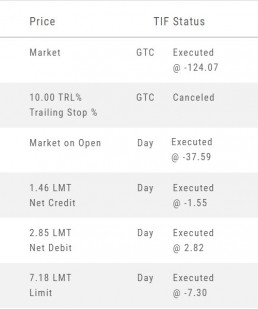

Order Types - How to Enter

Market Order are Buy or Sell orders to be executed immediately at current the Market Price. Execution of the trade is more important than price. As long as there is a willing buyer or seller, the trade will be executed.

Limit Orders (including Net Debit and Net Credit) allow you to set the Maximum Price to Buy or Minimum Price to Sell a security . Because these orders have ‘limits’ they may not be executed. When they are, they will be executed at the Limit Price – or better.

Low Volume, a slow or very fast market may mean your Limit Price may not be reached and thus, your order not executed.

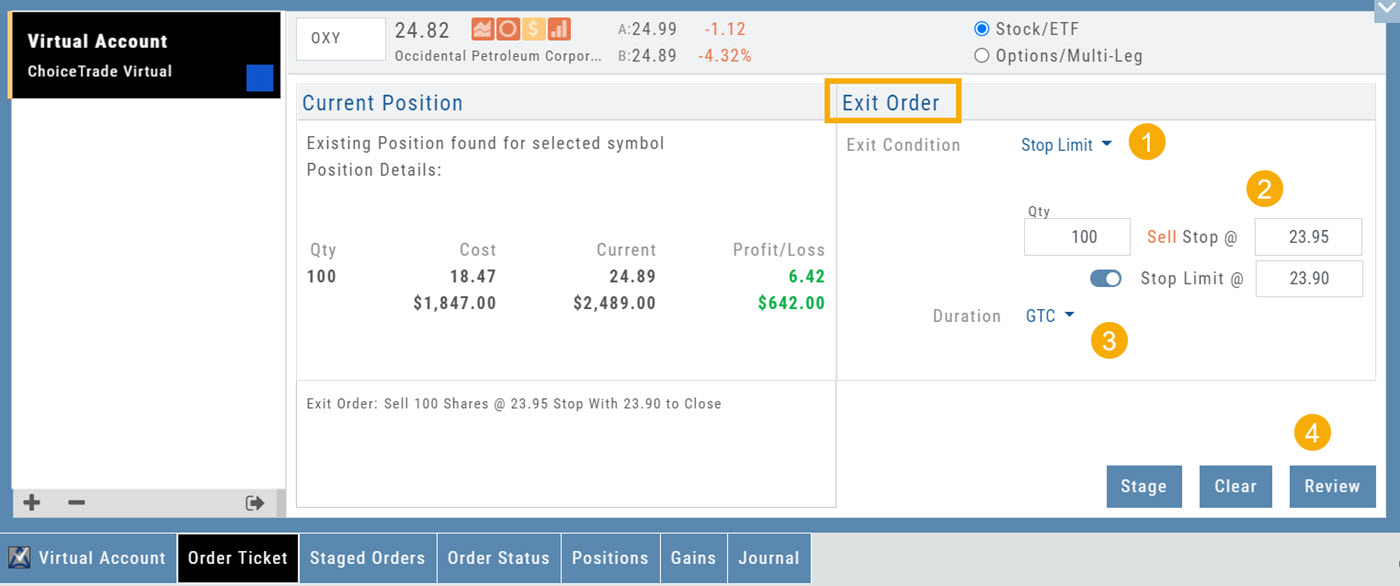

Stop & Stop Limit Orders

These are protective orders, to be placed on a current position.

A Stop Order becomes a Market Order when the Stop Price is reached. This does not mean you will get the Stop Price when the Order executes. You are willing to Buy/Sell at any price once your Price is reached to have the Order execute.

A Stop Limit Order generally offers more protection: Once the Stop Price is reached, the order converts to a Limit Order to execute once that price – or better- is reached. Thus, there are two values to enter on the Order Ticket for Stop Limit Orders.

How to enter a Stop Order/Stop Limit Order:

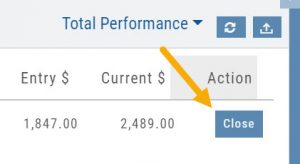

On the Positions tab, click “Close” for the Stock/ETF entry you want to add a Stop/Stop Limit Order to. You’ll be navigated to the Order Ticket tab to continue.

On the right side of the Order Ticket (Exit Order):

1. Change Exit Condition from default “Limit” to “Stop” or “Stop Limit“

2. Enter Stop Price. For Stop Limit Orders, the Stop Price will be the higher of the two values.

Enter Limit Price, if applicable.

3. Change Duration from Day (default) to GTC (which may vary by brokerage)

4. Review & Submit

Notes: As long as it’s not a Day order, the Stop/Stop Limit order will remain Live until you cancel the order or it executes*. (Some brokerages have expiration dates on such orders)

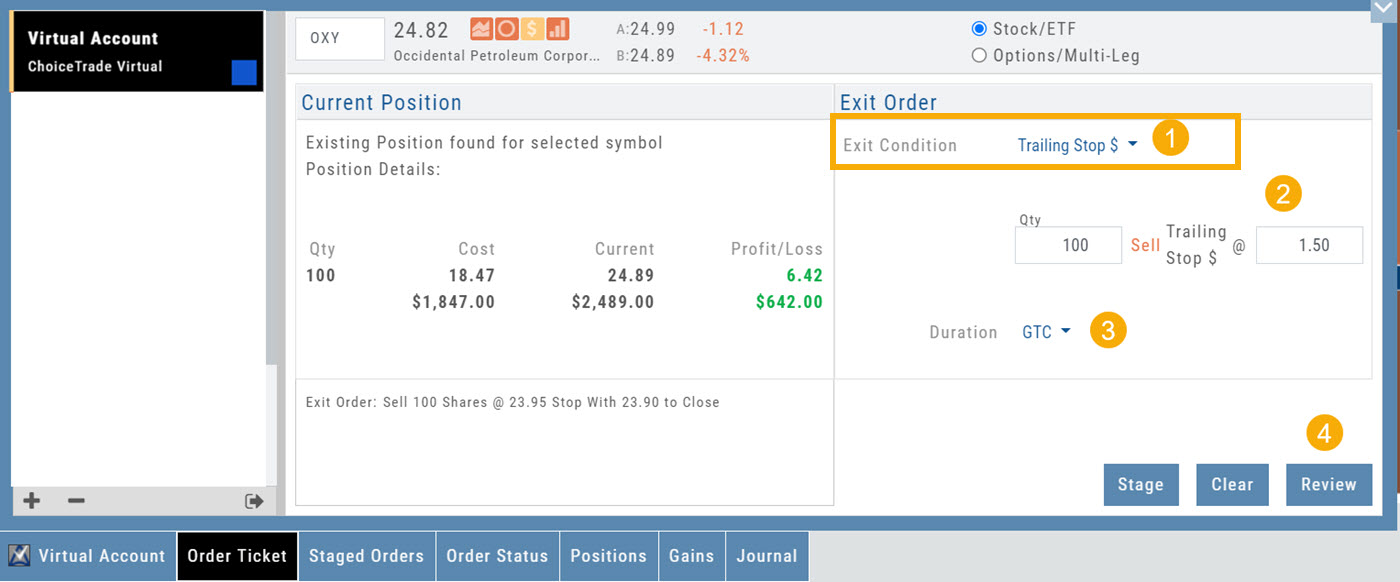

Trailing % and Trailing $

As the names suggest, these orders follow trades upward by a set $ or %. They are placed on a current position. Click “Close” from the Positions Tab, then follow the steps below:

1. Change Exit Condition to “Trailing % (or $)“

2. Enter price or percentage to exit trade

3. Select Duration (Day/GTC)

4. Review, then Submit

This will be a Live Order until it Executes, Expires or is Cancelled.

Bracket Order – One Cancels the Other (OCO)

- Opening Order OR the existing Position to Close

- Select “Bracket (OCO)”

- If the trade is favorable, the Limit Price will trigger to close and secure profit.

- If the trade is unfavorable, this Stop (or Stop Limit) Order can limit your loss

- Duration: “Day” or “Good Til Canceled”

- Summary of the Bracket-OCO Order

- Review for accuracy, then Submit on the next screen

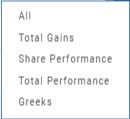

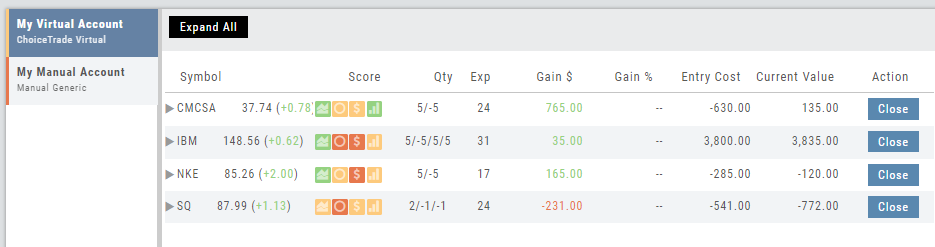

Positions Tab

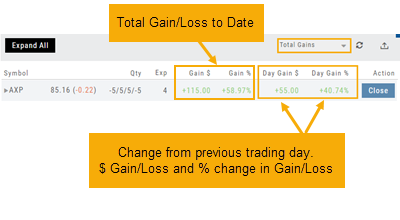

The Positions Tab offers 4 table views of your current trades. You can access these by clicking on the drop-down box in the upper right of the screen. “All” combines the 4 views.

Total Gains

This table view displays the Overall $ and % Gain/Loss and the Daily $ and % Gain/Loss based on the previous trading day’s results.

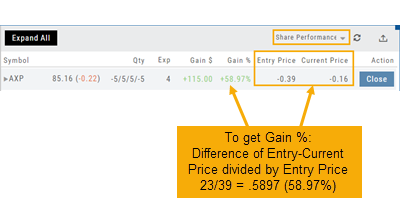

Share Performance

This table breaks down Total Gains by showing Entry Cost compared to Current Value per Share.

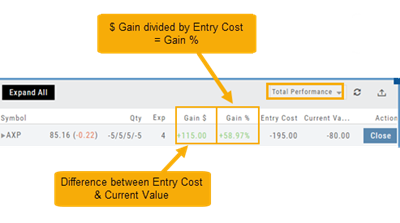

Total Performance

Similar to Share Performance, but shows Total Entry Cost and Total Current Value.

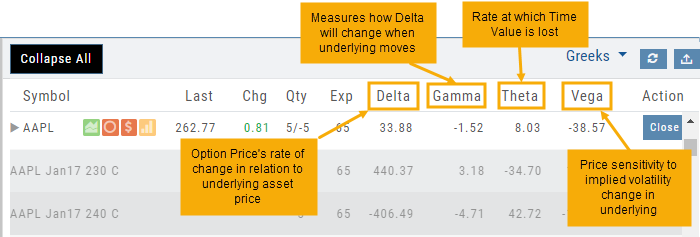

Greeks

Expand Trade Detail - Positions Tab

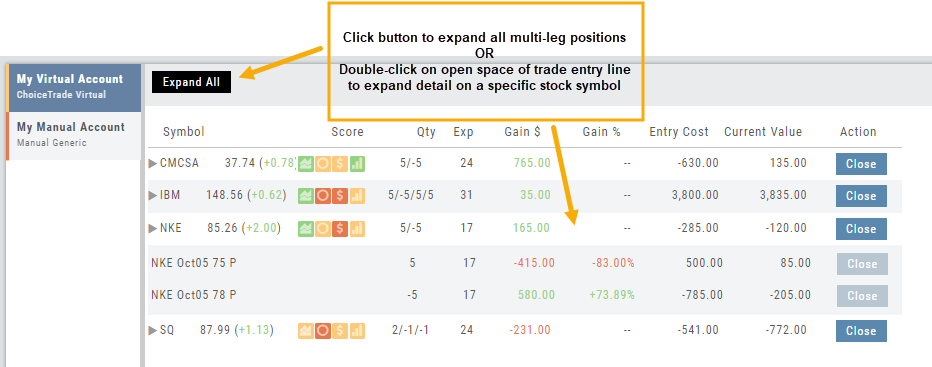

There are 3 ways to expand multi-leg trades in the Positions Tab.

Smart Icon – Click on the ![]() icon to the left of the stock symbol, select ‘Expand/Collapse’. Repeat to close.

icon to the left of the stock symbol, select ‘Expand/Collapse’. Repeat to close.

Expand All – Click the button above the trade entries if you wish to expand all multi-leg trades. Once clicked, the button will change to Collapse All.

Double-Click – if you want to expand one trade or specific trades, simply ‘double-click’ on an open space of the trade entry line. Repeat to close.