Key Ratio (formerly Valuation)

Key Ratio

A stock’s key ratios provide valuable insights into various financial aspects of the company. They are derived from the financial statements and help investors evaluate the company’s financial health, performance, and overall investment potential.

Assessing Key Ratios may vary by the type of trader one is: Growth Investors differ from Swing Traders who differ from Position Traders. The platform offers different views using Key Ratios for such scenarios.

Key Ratios allow you to not only view the company’s financial health but also view them in relation to others in the same industry, comparing ‘apples to apples’. Having this information allows you to better evaluate potential opportunities.

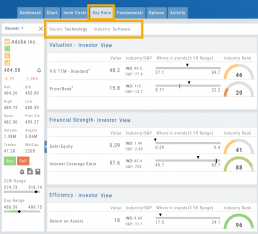

Deciphering the graphics

The illustrations show how to read the information provided as well as provide context on how the particular stock is performing to the Industry as well as the S&P.

Note: Depending on the Industry and/or S&P values, their tab(s) may not appear on the bar graph.

Select the view that matches your style of trading.

Just like trading, there is no ‘one-size-fits-all’. Those focusing on longer-term trades would not be interested in the same criteria as those who prefer shorter-term positions.

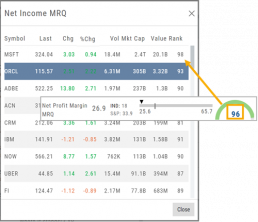

Clickable Key Ratio Value

View other industry stocks’ ranking by clicking on the numeric value as shown.

What does “N/A” or “–” indicate?

If a number does not appear in the Ratio criteria, you will see either a “N/A” or “—“

N/A indicates the datapoint is applicable, but the value not currently available

— indicates the data point does not apply, such as Inventory Ratios with Banks

Platform Features Release: July 2023

Announcing the latest Release of feature and functionality enhancements to the trading platform with the goal of improving the investment/trading decision process. These two areas of the platform have undergone a major redesign and expansion of metrics.

Key Ratio Tab(formerly Valuation)- Reworked and expanded data points offered as well as provided context of how well a stock is performing compared to its Industry and the S&P.

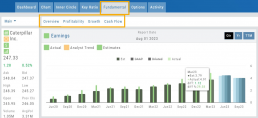

Fundamental Tab – Improved display of the expanded data available offer the ability to view fundamental metrics by Quarter, Year or Trailing Twelve Months (TTM) with the ability to adjust the time period and data display views.

Register for Office Hours, Wednesday, July 12th

Join us for a special Office Hours session, Wednesday, July 12th at 4:15 Eastern (15 minutes after Market Close)

Rance will be showcasing the Key Ratio and Fundamental tab data – how to read, understand and utilize the metrics provided.

Register using the button below. A confirmation email will be sent with a link to join for the scheduled time.

Key Ratio Tab

Key Ratio analysis is just one approach to evaluating stocks, and it should be complemented with other forms of analysis, such as technical analysis and market sentiment, for a well-rounded investment decision.

Key ratio indicators provide valuable information about a company’s financial health, profitability, growth prospects, operational efficiency, and overall value enabling traders to make more informed decisions:

Valuation: Helps determine whether a stock is priced attractively in relation to its earnings, sales, or book value.

Profitability: Signifies a company’s ability to generate returns for its shareholders.

Financial Strength: Assesses the ability to meet financial obligations and weather economic downturns.

Growth: Analyzes potential for expansion and increased earnings over time.

Efficiency: Measures how effectively a company utilizes its resources to generate output.

Cash Flow: Provides insights into the company’s ability to generate and manage cash.

Fundamental Tab

Fundamental Analysis involves a comprehensive examination of a stock’s financial health and its underlying value, as well as other relevant financial and non-financial metrics, to form an overall view of a company’s financial health and value.

This information is displayed in charts and graphs making it more useful in the analysis process.

It’s important to note that fundamental analysis is just one approach to evaluating stocks, and it should be complemented with other forms of analysis, such as technical analysis and market sentiment, for a well-rounded investment decision.

Enhancements

Price has been added to the Volatility Chart on the Option Chain display. Slide your cursor along the chart to display the Date, Price, HV & IV

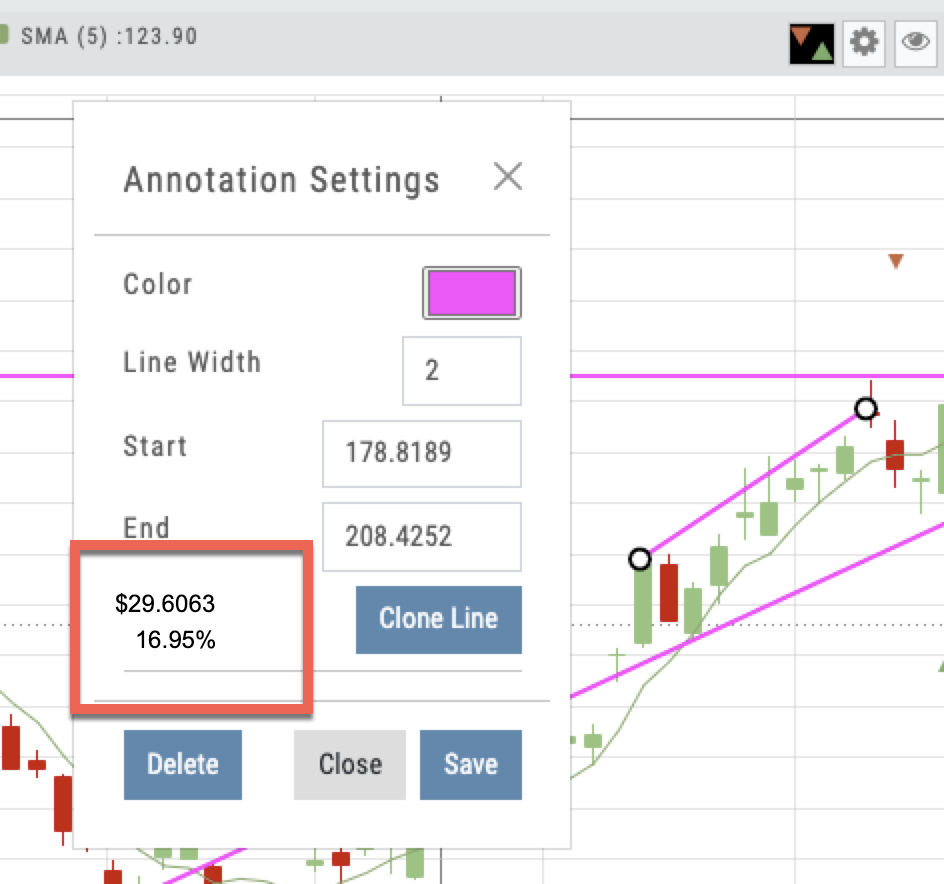

Dollar and Percentage Move added to Line Settings:

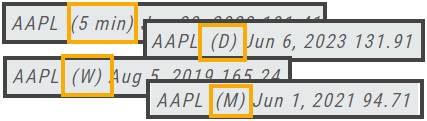

Timeframe displayed on chart when not on “Favorite”:

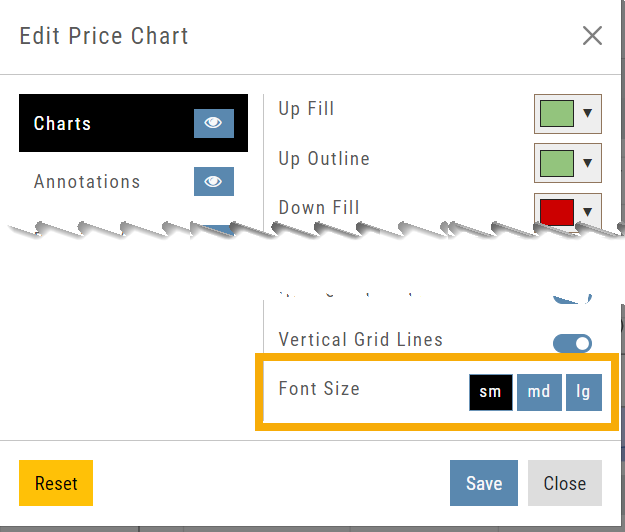

Font Size Selector for Price Chart

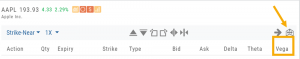

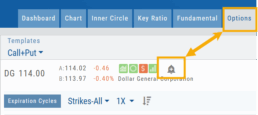

Vega added to Strategy Templates. Click the ‘expand’ icon, if needed:

Change Log

- Linear Regression Channel period number updating

- Roll-out time icon synced with Risk Graph

- Added “No or Limited Dividend Information” message

- Corrected Backtest Net Debit/Net Credit responsiveness

- Reset button function restored on Projected Price

Fundamentals Tab

Fundamentals

Fundamentals provide valuable insights into the financial health and performance of a company. They offer a comprehensive analysis of the company’s operations, profitability, growth potential, and overall stability.

Fundamentals are comprised of Earnings, Dividends, Price Projections, Profitability, Growth, and Cash Flow.

Profitability, Growth, and Cash Flow offer even more detail. Either click the button in that section:

![]()

OR click the appropriate category at the top of the window:

Earnings data provide insight into a company’s financial health and performance.

Past earnings reports offer insight into the company’s historical growth, profitability, and stability. Positive earnings trends may indicate a well-performing company. Negative or declining earnings could be cause for concern.

Earnings

Earnings projections provide forecasts of a company’s future earnings to gauge Market sentiment and investor expectations. Projections are compiled by financial analysts using factors such as industry trends, company guidance, and economic conditions. Surpassing or falling short of projections can greatly impact stock price.

Some benefits to both the company and shareholders include:

Income Generation

Shareholder Loyalty

Return on Investment

Dividend Reinvestment

Signal of Financial Health

Possible Tax Advantages

Disciplined Capital Allocation

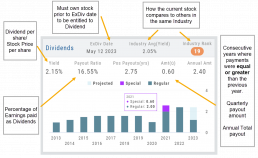

Dividends

The decision to pay dividends is up to the company’s management and board of directors, who weigh various factors, including the company’s financial position, growth prospects, and other capital allocation priorities. Dividend payouts are not guaranteed and may fluctuate or be suspended based on the company’s circumstances and strategic considerations.

Price Projection

Discount Rate

Determining the appropriate discount rate for a stock is a subjective process and depends on various factors.

Here is an example:

- Risk-Free Rate: Start by considering the risk-free rate, (the theoretical rate of return on a risk-free investment such as government bonds). This serves as a baseline for the discount rate. An online search can locate this information for you.

- Risk Premium: Assess the risk associated with the specific stock you are evaluating. Stocks are inherently riskier than risk-free investments, so you need to add a risk premium to the risk-free rate. The risk premium accounts for the additional return expected by investors for taking on the extra risk. The risk premium can vary depending on factors such as industry, company-specific risks, economic conditions, and market volatility.

- Beta: This measures its sensitivity to market movements.

Beta of 1 = the stock moves in line with the overall market

Beta > 1 = the stock has higher volatility and would warrant a higher discount rate to reflect the increased risk. - Company-Specific Factors: Are there unique company factors (financial health, competitive position, growth prospects, management quality, etc) that could positively or negatively influence the discount rate?

- Sensitivity Analysis: Changing the discount allows you to assess the impact of the stock’s valuation. Some sectors are subject to more volatility than others: the Energy and Material Sectors tend to be more volatile than Consumer Staples or Utility Sectors.

The discount rate is subjective. Different investors might have different views on what the appropriate discount rate is for a given stock, based on their own risk tolerance, the specific risks associated with the company, and their expectations for future market conditions.

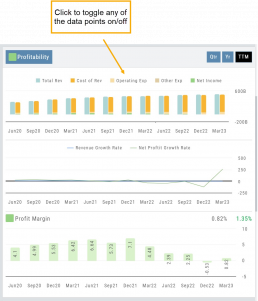

Profitability

Revenue: Money generated from sales of goods or services. It is income earned prior to deducting expenses or costs

Cost of Revenue: Expenses directly related to production, manufacturing, or acquisition of products/services sold. Typical examples include raw materials, labor, overhead, etc.

Operating Expenses: Day-to-day, necessary operating expenses not directly related to the production/acquisition of goods/services. Examples: Wages, utilities, depreciation, advertising, etc.

Other Expenses: Depending on the nature of the business can include: Taxes, Interest, Non-operating losses, Restructuring, Non-recurring, etc.

Revenue Growth Rate: Percentage change (+/-) in a company’s sales/revenue over a period of time:

Revenue Current–Revenue Previous/Revenue Previous x 100

Net Profit Growth Rate: Percentage change (+/-) in a company’s net profit over a specific period of time:

Net Profit Current–Net Profit Previous/Net Profit Previous x 100

Profit Margin: Percentage of revenue a company retains after deducting all expenses.

A higher profit margin indicates a company is generating more profit relative to its revenue. A lower percentage suggests higher expenses in proportion to revenue.

Growth

Asset: These can vary by industry/company. Common examples that contribute to a company’s growth are Financial, Intellectual Property, Human Capital, Physical Assets, Technology/Info Systems, Customer Base, Brand Equity, Partnerships, and Networks.

Debt/Equity Ratio: Total Debt divided by Total Equity. Interpretation varies by industry and a company’s specific circumstances: a high ratio can indicate higher financial risk OR effective management of debt through cash flow. A low ratio can indicate a conservative financial position OR under-utilization of debt and missed opportunities for growth.

Non-Current Assets: Resources not intended to be converted into cash or used up within a year.

Assets: Anything of value that has the potential to generate future economic benefits.

Liabilities: Obligation or debt a company owes to external parties that must be fulfilled in the near future.

Long-term Liabilities: Obligation or debt a company owes but has more than a year to repay.

Equity: The portion of a company’s value belonging to its owners or shareholders after all debts and obligations have been settled

Operating Cash Flow: Represents the cash inflow/outflow directly related to day-to-day activities including sales of goods and services, paying operating expenses, and collection of receivables.

Free Cash Flow: Cash flow available for discretionary use after accounting for operating expenses, capital expenditures, and changes in working capital. Positive values offer opportunities, negative values may indicate financial challenges.

Cash Flow

Cash Margin %: Percentage of cash generated from a company’s sales revenue after deducting its cash operating expenses. It measures the profitability and efficiency of a company’s operations to generate cash.

Cash Indicator: The industry percentile ranking of a company’s ability to generate cash from its operations.

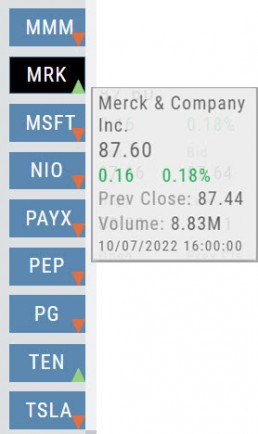

Price Change Indicator

Green and Red Arrows have been added to each symbol tab when in Research.

This applies to any selected Watchlist or the default “Recents” list.

Each time one symbol is clicked, the entire list will update the latest price update.

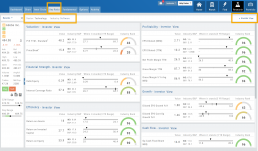

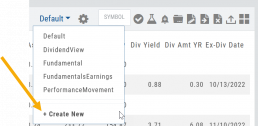

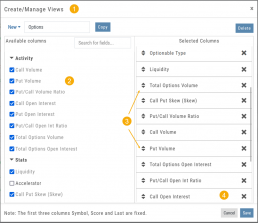

Customize Watchlist Views

Customize Watchlist Views

You have the ability to customize Watchlist Views – based upon criteria you want to see.

Click on the ![]() next to “Default” or current view you are on to create a different View.

next to “Default” or current view you are on to create a different View.

If/When you want to edit any of your personal views, simply click the ![]() icon, remove/add criteria, adjust placement, then click “Save”.

icon, remove/add criteria, adjust placement, then click “Save”.

From Assets to Z-Score, there are over 160 data points to select from including data from: Company Information, Technicals, Valuation, Fundamentals & Options.

Simply:

1. Name the View

2. Select Data Points

3. Arrange – clicking on arrows to move up/down

4. Save

Your Watchlists are now more powerful because they show the data you want to see to help you make your trade decisions.

The Result:

Note: The Symbol, Score Icons and Last Price are fixed

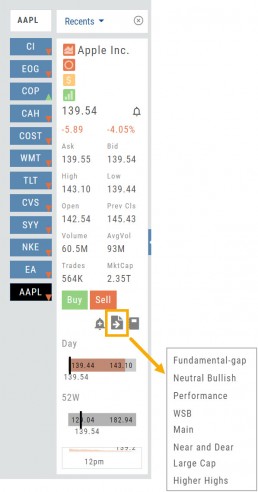

Research Your Watchlists

Research Watchlist Functionality

Users are able to access all Watchlists from the Research Tab.

Click the ![]() to access the dropdown list as shown in the graphic.

to access the dropdown list as shown in the graphic.

Lists with more than 20 symbols will have a scroll bar allowing for easier research of larger lists.

All other functionality remains the same: Symbols can be moved to other lists, have alerts set, deleted, add Journal notes

When a symbol is entered in the Symbol Search Box on the Research Tab, the symbol will automatically be displayed on the default “Recents” list.

In addition, when a symbol or group of symbols is sent to Research from anywhere else on the platform, it will appear on a list under the default “Recents” list.

Examples of when the “Recents” list will be displayed:

- Sending a symbol/symbols from a list on a Watch Tab.

- Selecting a group of symbols from a Scan or Screener list.

- Clicking on the Technical Icon from any symbol when not in the Research Tab. will be displayed under “Recents”.

The functionality of adding a note, an alert or sending a symbol to a specific list remains the same.

Alert Functionality (Premium Desktop Feature)

Alert Functionality

Alerts can greatly improve trading effectiveness by notifying you on a potential trade opportunity and help you decide when to manage, enter or exit a trade.

Set up Alert notifications based on Last Price, Volume, $ Change, % Change, or % Offset.

If you’ve logged into the platform with either Streaming Quotes or RealTime Quotes through a linked brokerage account *within the last 30 days* – Alerts will be Real Time.

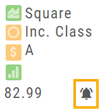

Alert Icons

- Add (+) New Alert – This icon is located on the symbol Quote Box

- Hollow Bell – Active Alert, not triggered

- Shaking Bell – Triggered alert, not yet viewed

- Solid Bell – Alert triggered today, already viewed

- Paused (z) or Used Alert – located in Alert Management Page

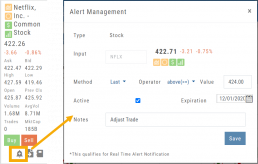

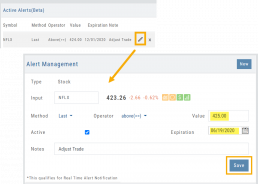

Set Your Alert

Click the Alert Icon, located on the symbol Quote Box and as shown on the Option Tab for the Chain or Strategy Template. The symbol, Score Icons, Last Price, $ and % Change automatically fill in. To complete the rest:

-

-

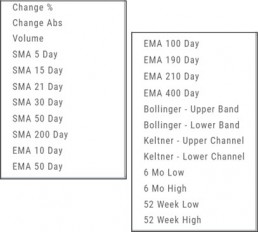

- Select Method: 23 to choose from! See list below

- Select Operator: Above/Equal To or Below/Equal To

- Enter Value: $, % or Quantity (Quantity example: 11,000,000 or 11M)

- Select Expiration: Valid up to 6 months. Click on Calendar Icon to navigate months

- Add Notes, if desired

- Click Save

An Information notification appears: Alert Successfully Saved

-

Alert Management

Manage your Alerts by going to: Research Tab>Alerts.

From this page, you can modify or remove alerts, view unread triggered alerts in one location and view prior alerts.

-

-

- Select Method: See List on right

- Select Operator: Above/Equal To or Below/Equal To

- Enter Value: $, % or Quantity (Quantity example: 11,000,000 or 11M)

- Select Expiration: Valid up to 6 months. Click on Calendar Icon to navigate months

- Add Notes, if desired

- Click Save

An Information notification appears: Alert Successfully Saved

-

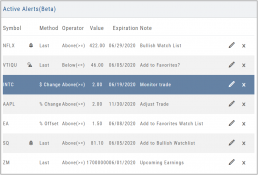

Active Alerts

This table lists all active alerts including:

Trigger notification – A bell icon appears if alert was triggered

Delayed Alert icon, if applicable

Settings – Method, Operator, Value

Expiration Date – Alerts can be active for up to 6 months

Notes

Ability to modify or remove from list

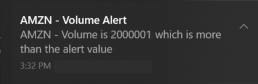

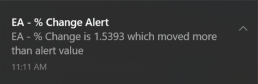

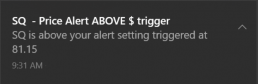

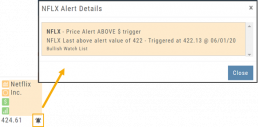

Alert Notifications

In addition to platform notifications, as long as you allow notifications, alerts can be sent to your computer or mobile device even if you are not logged into the platform.

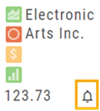

Hollow Bell

The Hollow Bell indicates this Alert is Active, but has not been Triggeredwill appear next to the symbol whether on the QuoteBox in Research or on a Watchlist .

Ringing Bell

The Ringing Bell icon indicates the alert has been triggered and notification sent out. The highlighted area on the Quote Box or where it appears on a Watch List allows you to access the alert notification by clicking on the bell.

This display will show until the alert is read either from a Watch List, Quote Box or the Alert History section of the Alert Page.

Solid Bell

Once an Alert is read or “Marked As Read” on the Alert Notification page, the icon becomes a Solid Bell.

Clicking on the icon will still display the triggered alert until the next Market Day.

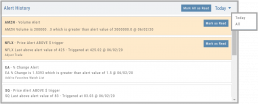

Alert History

This section displays triggered alerts for the time period selected: Today or All. The highlighted entries are Unread Notifications – the notices were not clicked on from the platform.

Click “Mark All as Read” to update entries.

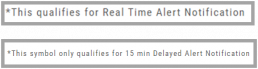

A note about Real-Time & Delayed Alerts

Note: There are two ways 15 minute Delayed Alert Notification applies with Alerts:

1. If it’s been more than 30 days since a linked brokerage account with RealTime Quotes has been logged into – OR – the platform does not have Streaming Quotes.

2. OTC stocks will show as delayed, regardless of RealTime or Streaming Quotes

One of two notices will appear for each Alert

Research

Narrow the field to find the highest probability trades.

Stock

You’ve narrowed the field by selecting potential candidates matching the outlook and selected strategy, but which of those have the highest probability of success? Research allows you to drill down for information as much or as little as you want.

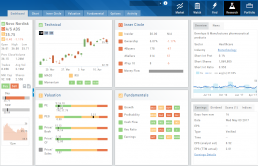

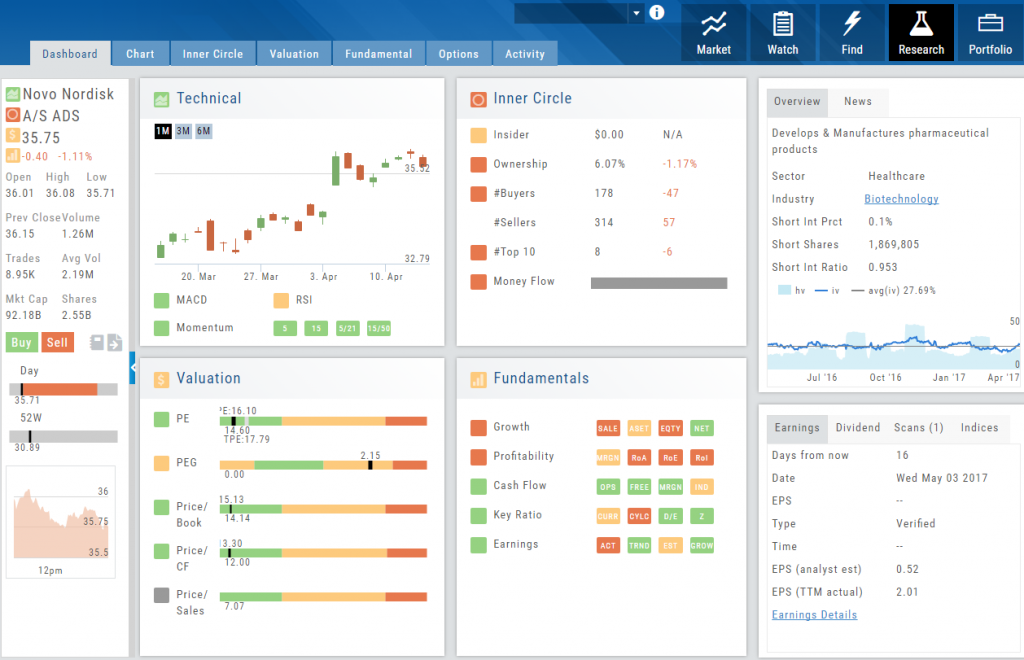

The Dashboard provides an overview: Quote Detail, The Score, Activity such as News/Earnings/Dividends and information about the Company and a list of other company stock symbols in the same industry. Each component has it’s own tab to provide more detail.

Components of The Score are designed to keep the information available to you, but out of the way when you don’t need it.

The Options Tab offers Strategy templates, option chains, snapshots and definitions of strategies, P/L Graph with Risk/Reward ratio, Analytics and Stock/Volatility charts.

The Activity Tab includes a Beta version of the Journal as well as News and StockTwits ®

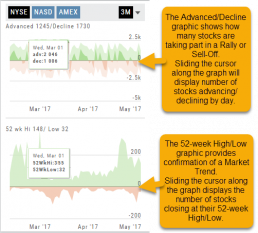

Advanced/Declined & Highs/Lows

The Graphs on the left side of the Market page can provide confirmation of whether there was a Rally or Sell-Off in the time frame selected by providing the numbers of stocks taking part in of the movement.

The 52-week High/Low Graph further confirms if there is a Market Trend by showing how many stocks closed at their 52-week High/Low.

Note, you can select a 1, 3 or 6 Month or 1 Year time frame in which to view the data. By sliding the cursor along the horizontal ‘0’ (zero) line on each graph, data for each day will appear.

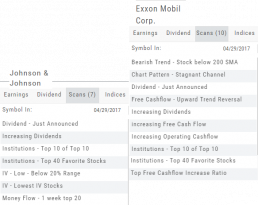

The Dashboard Scan Tab

Get the current ‘story’ on a stock.

The Scan Tab is particularly interesting. In addition to providing a list of scans the stock is currently included in, it can give you a “story” about the stock. Based on the scans that the stock is showing up in, you can get an overview of outlook on the stock.

For example: JNJ shows solid longer term positive outlook.

XOM Shows stagnant with improving longer term outlook