Price Slices - Premium Feature

Price Slices

Price Slices allow users to view theoretical outcomes of option positions, while providing the flexibility of changing data points, such as entry price or what the results will be if the stock price moves a specific dollar or percentage amount.

This feature is helpful with building discipline on when to exit a trade if it goes against you.

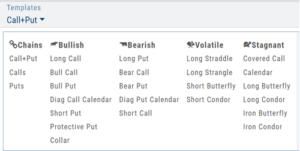

This feature is accessible when using the Strategy Templates on the Research>Option Tab

The default starting points include:

- Entry Point – shown in Blue in our example.

- High Point – considered Target or Resistance point – shown in Green.

- Low Point – considered Stop or Support point – shown in Red

(Up to 7 Price slices can be added for additional evaluation. See below for more details)

On Research>Option Tab, click the down arrow next to the default “Call+Put” view in the upper left corner of the window to access the Strategy Templates:

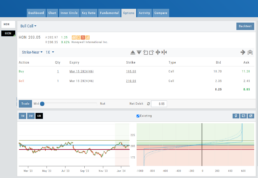

Select your Strategy and set up the position:

Quantity, Expiration Date, Strikes

On the right side of the same screen, click the ![]() button to display the default settings.

button to display the default settings.

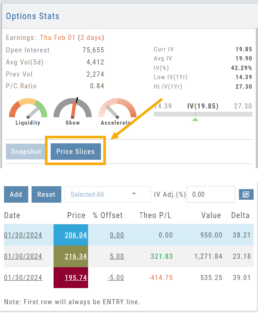

Using our example:

Entry point is $206.04 (Current Stock Price) shown in Blue

High point – defaults to 5% above Entry: $216.34, shown in Green/Gold

Low point – defaults to 5% below Entry: $195.74, shown in Red

The values are for ‘today’: what the Profit or Loss would be if the stock price were the High or Low price.

The Date, Price and/or % Offset can be manually adjusted, as indicated by the underline – to view different scenarios.

Price Slices – Adjust the % Offset Value

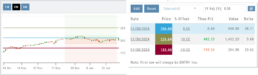

% Offset values were manually changed to 10% and -10%.

The lines on the graph are dynamically updated

Price Slices – Adjust the lines

In this example, the Top and Bottom lines were adjusted on the graph itself.

The new placement dynamically updated the values on the right.

Price Slices – Add, Reset, Go Big

Platform Features Release: Trade from the Chart, Price Slices, Reset Virtual Account Options

Announcing the latest Release of feature and functionality enhancements to the trading platform to improve the position evaluation process, trade submitting process as well as offer additional practice account settings:

Price Slices: Evaluate theoretical outcomes of option positions when using the Strategy Templates.

Trade from the Chart: Use the control box or lines on Chart to adjust the entry point, Target Price and/or Stop Price.

Reset Virtual Account – Add ‘funds’ to an existing account OR reset everything and start fresh. You decide.

Price Slices (Premium Feature)

The ![]() Button appears on the right side of the screen when using the Strategy Templates.

Button appears on the right side of the screen when using the Strategy Templates.

Select one of the 22 Option Strategy Templates.

Build the position.

Click the Price Slices button to start your evaluation

Change the Date (default ‘today’), Price levels and/or % Offset

Add IV to view how this affects the theoretical P/L

Click the Go Big icon to view additional Greek data

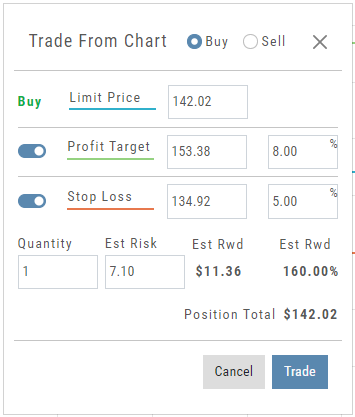

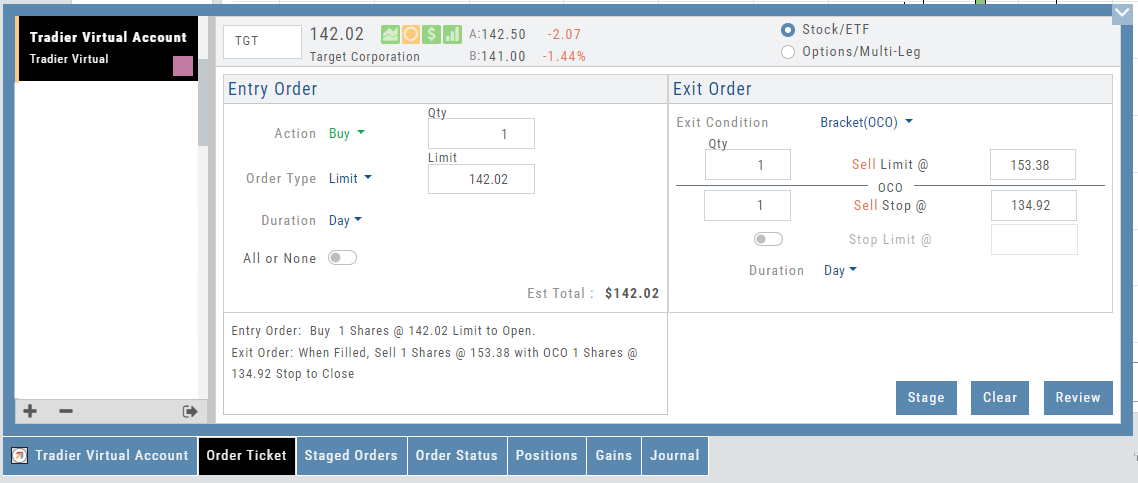

Trade from the Chart

The ![]() button appears at the top of the chart for any symbol – whether there is an existing position or not.

button appears at the top of the chart for any symbol – whether there is an existing position or not.

Clicking this button activates an Order Window on the Chart, like this:

Note: Buy, Profit and Stop Loss line colors will match those displayed on the chart itself.

The values in the Order Window can be manually adjusted by $ or %

The values can also be dynamically adjusted by moving the corresponding line(s) on the Chart itself.

The Quantity value default is “1” to show the ‘per share’ dollar and percentage estimated risk, reward, as well as Position Total.

Click “Trade” for the prefilled Order Ticket to display.

The Order Ticket can be further adjusted, Staged or Reviewed to ensure it’s completed to your satisfaction, then Submitted.

Note: The brokerage selected must support Bracket Orders if the Stop/Stop Limit values are selected on the Order Window

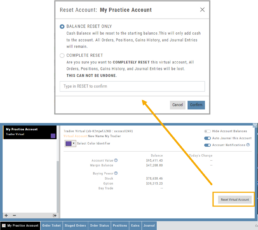

Reset Tradier Virtual Account – 2 options

Tradier’s Virtual Account gives you the ability to add more “Cash” to your practice account – OR – completely start over:

On the account summary page, click “Reset Virtual Account”

Select “Balance Reset Only” – to keep your existing trade activity, but add more “cash” to your virtual account.

Select “Complete Reset” – if you want to remove all prior transactions, including Journal Entries, Gains, Orders, Positions, etc. Note: This selection cannot be undone once it’s processed.

Type RESET in the box provided, then click the “Confirm” button

Enhancements

- ATM Option Strikes are bolded for easier identification

Change Log

- Adjusted theme contrast

- Corrected Order Type Limit price entry

- Snapshot functionality restored

Platform Features Release: New Option Chain Functionality/Appearance, Responsive P/L Graph

Features Release Notes:

New Option Chain Functionality/Appearance, Responsive P/L Graph

Announcing the latest features/functions updates, additions or edits to the trading platform:

Option Chain Functionality/Display has been revamped to allow users to control which information to view and increase responsiveness. Symbols, such as SPY and SPX, will load noticeably faster. An incorporated Dashboard provides a snapshot of current activity allowing users to make more informed decisions.

Responsive P/L Graph adjusts when the slide bar between Bid and Mid price is adjusted. This is especially helpful when the spread is considerable.

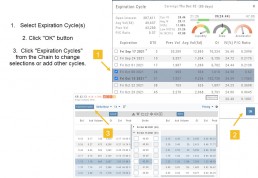

Option Chain Display/Functionality

Select Expiration Cycles

The redesigned Option Chain allows users control of what Expirations to view instead of the platform defaulting to a cycle approximately 30 days out.

Click on the Options Tab from Research.

A window with available Expirations will appear along with a Dashboard with pertinent information (Volume, IV, OI, Earnings Date, etc) for more informed decision-making.

As a bonus, this structure allows data to load faster – especially helpful for those symbols with large option chains.

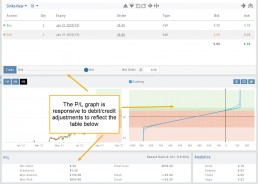

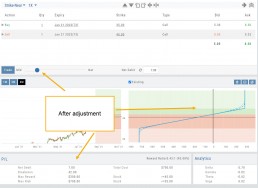

Responsive P/L Graph

The P/L graph on the Options Tab is responsive to adjustments made to the trade set up for the entry Net Debit/Net Credit.

Note, the smaller the spread between the Bid/Ask, the smaller the graph adjustment will be.

The example illustrates a large spread to better illustrate this feature update.

Change Log

- Price representation on chart X/Y axis corrected

- Journal Notes enhancement

- Saved screeners adjustment

- Active Watchlist access corrected

- Close from Backtest saves Symbol

- Clarified wording on Warning Message

- Mobile version of Saved and System Screener

- Mobile app – rolling trade adjustments

- P/L ‘Go Big’ data correction

- Account Summary page enhancement

- Large number displays on HeatMap

Intraday Trade Finder Scan Updates (Premium Desktop Feature)

Trade Finder Scans are updated every 30 minutes during Market Hours on the Premium Platform. That’s 12 more times than the Standard Platform version, which updates once after the Market opens.

Trade Finder Scans are easily identified with a Rocket Icon in the upper left corner of the Scan box.

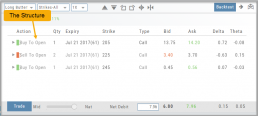

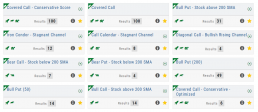

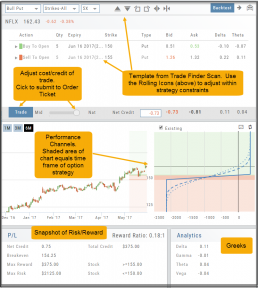

Strategy Template

A Strategy Template provides a shortcut to quickly create an option strategy, virtually eliminating structure errors. Once selected, you can modify the structure within the template using the tools on above the option tables: Moving Strikes up/down, rolling Time out/in, widening or narrowing Strikes.

![]()

Some strategies can be changed from all Calls to all Puts (and vice-versa).

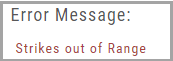

Note: The templates will not allow you to exceed certain parameters, as attempting to do so would result in an invalid strategy. This is a built-in safety net and you would receive a notice similar to:

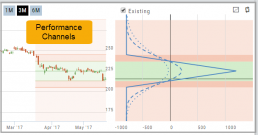

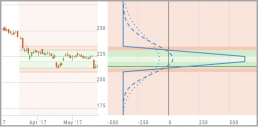

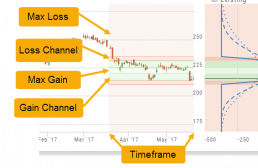

Performance Channels

Performance Channels can assist in visual analysis across both the P/L Graph and the Chart.

- Dark Green – Stock movement affects gain

- Light Green – At maximum gain

- Dark Red – Stock movement affects loss

- Light Red – At maximum loss

The width of the channel on the chart represents the timeframe of the trade. If options expire in 30 days, the channel will display back 30 days on the chart. This give a visual reference for the time frame of the trade.

Note: Channels are displayed based on expiration of the trade. Past performance is not indicative of future results. Performance channel date orientation is for reference only.

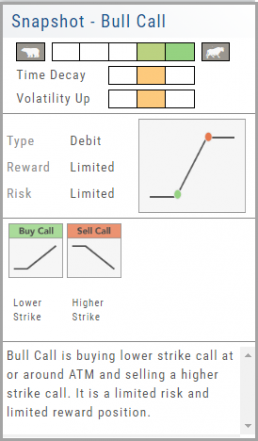

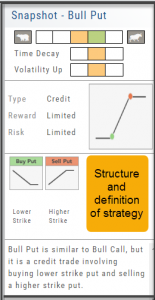

Strategy Snapshot

It’s the “Cliffnotes” version of your strategy

Each strategy template provides a quick reference for the construction and application of the strategy. The snapshot shows:

- what the strategy outlook is on the color-coded range from ‘Very Bearish’, ‘Mildly Bearish’, ‘Neutral’, ‘Mildly Bullish’ or ‘Very Bullish’.

- what effect ‘time decay’ and ‘volatility’ has on the strategy: ‘Increase’, ‘Neutral’ or ‘Decrease’.

- debit or credit trade

- risk & reward level

- strategy structure

- an overview summary of the strategy

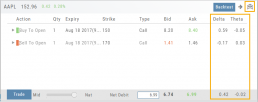

Elements of the Template

The Trade Finder Templates are designed to allow you to ‘visually trade’.

When evaluating a position, a Bull Put for example, the template automatically sets up the trade. You can use the rolling icons to adjust the position: Roll the position up/down, roll out the time frame, adjust the strikes, etc. You can even adjust the Net Credit(Debit) of the trade in an attempt to get a more favorable entry cost/credit.

The Performance Channels show the profit/loss of the position.

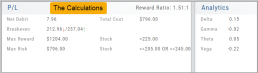

The P/L summary at the bottom left of the screen shows the Risk/Reward ratio, Net/Total Credit (Debit),the break-even stock price point, the max reward/max risk with corresponding stock price.

A snapshot on the right side of the screen, provides a visual structure of the strategy, what market  conditions are favorable to the trade, whether volatility and/or time positively, negatively or is neutralized by the strategy.

conditions are favorable to the trade, whether volatility and/or time positively, negatively or is neutralized by the strategy.

Greeks and Volatility are also shown.

Once satisfied with the position set-up, click ‘Trade’ and the order will auto-fill in the “Order Ticket” of your brokerage account.

Important! While adjustments may to the template may be made, the system limits what can be changed in order to stay within the constraints of the strategy. This safety measure ensures you stay in the type of trade you intend to be in.