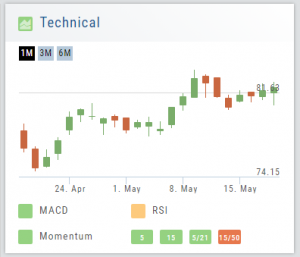

Technical Analysis

Technicals: The fastest indicators of The Score

In Technical Score, 3 primary categories of studies are evaluated – MACD, RSI, and Momentum.

Momentum is made up of 4 different trend analysis timelines.

5 = Stock over the 5-day moving average

15 = Stock over the 15-day moving average

5/21 = 5-day moving average over the 21-day moving average

15/50 = 15-day moving average over the 50 day moving average

Note: Momentum indication is from fastest to slowest. This can be helpful in determining your time frame/outlook for the appropriate strategies.

By clicking on the Technical Score Icon anywhere in the platform, you’ll be taken to the Chart Tab under Research for that Company/Symbol.

Go to Charts for more in-depth information.

Performance Channels

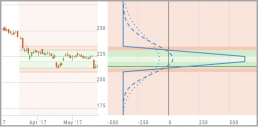

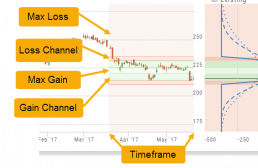

Performance Channels can assist in visual analysis across both the P/L Graph and the Chart.

- Dark Green – Stock movement affects gain

- Light Green – At maximum gain

- Dark Red – Stock movement affects loss

- Light Red – At maximum loss

The width of the channel on the chart represents the timeframe of the trade. If options expire in 30 days, the channel will display back 30 days on the chart. This give a visual reference for the time frame of the trade.

Note: Channels are displayed based on expiration of the trade. Past performance is not indicative of future results. Performance channel date orientation is for reference only.

Earnings, Dividends and more...

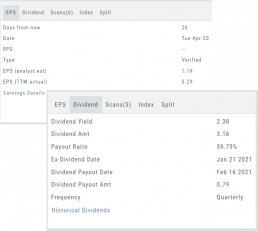

The far right, lower box in Research provides the following:

Earnings Tab: Get Earnings date, number of business days until announcement, Estimated and Actual Trailing Twelve Months (TTM) EPS, and link to the prior 12 Quarter Earnings details.

Dividend Tab: Get Yield, Amount, Payout Ratio (dividend/EPS), the Ex-Dividend Date (deadline to complete a stock purchase to be entitled to dividends), Payout information, Frequency and link to the prior 12 Quarter Dividends.

Scans Tab: Quickly view how many & which scans the stock symbol appears on.

Index Tab: Lists the symbol and indices name(s) on which this stock appears.

Split Date: Provides most recent Split Date, Detail and a link to view Split History

Chart Navigation

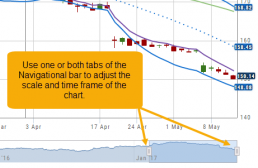

Hovering the cursor over the icons will display it’s function.

In the upper right of the Chart screen, you can select which Chart Profile to research from the drop-down box, then save or delete the profile.

The next set of icons immediately below this gives more charting capabilities: Increase/Decrease price ranges, Reset price range, Hide/Show Navigation Bar, Move the date Back/Forward, Export/Print Chart

![]()

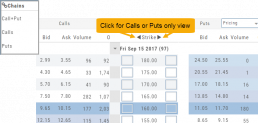

Chain Views

Different views are available for options such as Calls + Puts, Calls only or Puts only. Select from the drop-down box or toggle the screen using the arrows ![]() in the chain header.

in the chain header.

In addition, there are over 20 strategy templates on the Options tab.

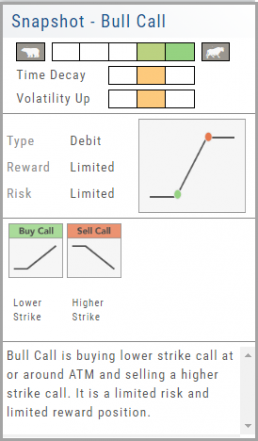

Strategy Snapshot

It’s the “Cliffnotes” version of your strategy

Each strategy template provides a quick reference for the construction and application of the strategy. The snapshot shows:

- what the strategy outlook is on the color-coded range from ‘Very Bearish’, ‘Mildly Bearish’, ‘Neutral’, ‘Mildly Bullish’ or ‘Very Bullish’.

- what effect ‘time decay’ and ‘volatility’ has on the strategy: ‘Increase’, ‘Neutral’ or ‘Decrease’.

- debit or credit trade

- risk & reward level

- strategy structure

- an overview summary of the strategy

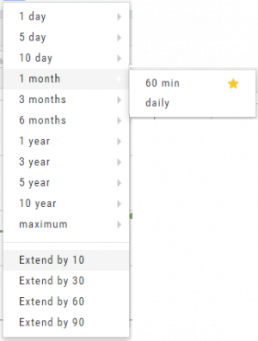

Chart Periods

You can add/remove and even extend Time Periods

Use the plus (+) to select the length and periodicity to display. Intervals range from minute-by-minute for a 1 Day Chart to month-by-month for up to 25 years (Maximum)

![]()

Click the ![]() on any time period to add it to the header for easy access to frequently used selections.

on any time period to add it to the header for easy access to frequently used selections.

You may remove any favorite period by either clicking the “X” in the upper right of the button in the header or simply clicking the star again in the selector menu.

Finally, Extend the Chart by 10, 30, 60 even 90 periods beyond today to evaluate Chart Patterns. If you select “Extend By 30” on a daily chart, it will extend by 30 days. On a weekly chart, it will extend by 30 weeks. (Note: This feature is applicable to Daily, Weekly and Monthly charts).

Trend lines can be drawn through the extended period.

This feature can be toggled on/off by the same (+) in the header.

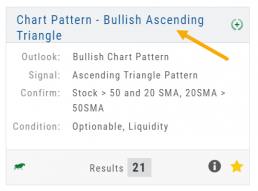

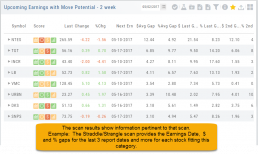

Dynamic Scan Information

The scan results provide relevant information for that scan. For example: Dividends will show Yield, Covered Calls will show the options position, potential return, net cost and more.

This allows you to quickly pick stock candidates and bypass others for high-probability trades. For example, you may wish to eliminate stocks priced too high or low, those with low volume, etc. Use the Navigational tools (Action Icon, The Score Icon, Send to Watchlist or Research for example) to dive deeper in selecting the best stock.