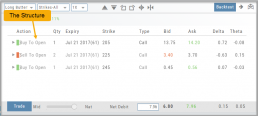

The Order Ticket - Stock/ETF

The Order Ticket is designed for ease of use and flexibility.

Selecting “Stock/ETF” or “Options” will display the appropriate ticket.

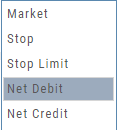

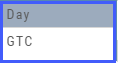

Brokerages determine what Order Types and Duration selections are available.

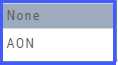

All or None allows you to dictate whether to accept partial fill of an order or not. Toggle to turn this on/off.

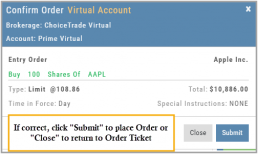

The Order Summary appears below Order details as an additional security step to ensure your order is correct.

Click “Stage” for later review, “Review” to continue the Order process or “Clear” to start over.

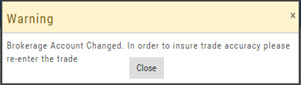

Note: If you start an Order in one account, then switch accounts, you’ll review the following notice:

Order Types are in a drop-down box and the types offered often vary from one brokerage to the next.

‘Duration’ – How long the order is good for: Day (current trading day) or GTC (Good til Cancelled)

‘Condition’ – Must be met for the order to be filled/executed: “None” (no conditions) or “All or None” (all of the order must be filled, or none at all).

After completing the order ticket, click ‘review’, then ‘submit’.

After completing the order ticket, click ‘review’, then ‘submit’.

Market - The Big Picture

Start here for the overall outlook.

Designed to show what the overall markets are doing by viewing the graphs, charts and maps. You can change the time frame to check trends, use the maps on the right side of the page for a picture of sectors in relation to the market. Even drill down to industry within the sector and more.

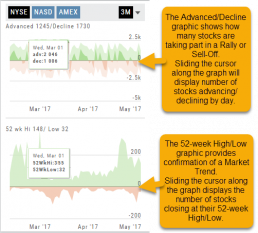

Market Overview: Get more of a broad view

View activity of the NYSE, Nasdaq or American Stock Exchange by time frame. The upper area of this part of the Market Tab shows the number of advancing or declining stocks by sliding your cursor along the graph.

Likewise, the bottom portion of shows the number of stocks that reached their 52-week High or Low by sliding your cursor along the lower graph.

The constant figures show the number of stocks in each category for the current/most recent trading day.

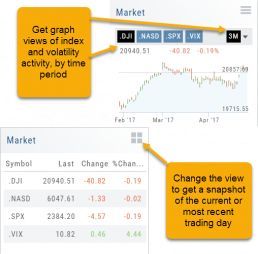

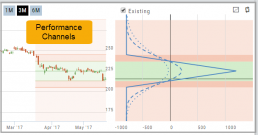

Market - Index Overview

In the default Graph View, get an visual view of Market or Volatility Index activity by a 1-day or 1, 3 or 6 month time frame. By sliding your cursor along the graph, an activity box will display more in-depth activity: Every two minutes for the 1-Day Graph, or Daily for the 1, 3 or 6 month graph.

The current market activity/most recent trading day, regardless of time-frame, is present on the default view under the Index box selections – or by selecting the List View to get: Current, point change and percentage change (green = positive, red= negative).

Options Navigation

Expirations are displayed above the Option Table.

Select the months to view by clicking on the appropriate box. All available dates are displayed. Remember, the further out the option expiration is, the fewer dates are available.

Toggle between Calls Only or Puts Only view.

Change Option Table views to Pricing, Value, Greeks, Trade or new Custom views you create to suit your needs.

The small tab on the left side of the table will collapse the stock summary box & widen the option table.

The scroll bar on the right side and slide bars at the bottom on the table offer additional navigation.

Top Level Navigation

Designed so trading workflow makes sense.

Home provides an overview of the current market from charts to maps and customize your own view.

Watch more detail of selected stocks matching overall outlook.

Find identify opportunities from scans, strategies, outlook and more.

Research gives you all the detail you need on the intuitive Dashboard

Portfolio keeps your accounts, trades and journal in one place.

Advanced/Declined & Highs/Lows

The Graphs on the left side of the Market page can provide confirmation of whether there was a Rally or Sell-Off in the time frame selected by providing the numbers of stocks taking part in of the movement.

The 52-week High/Low Graph further confirms if there is a Market Trend by showing how many stocks closed at their 52-week High/Low.

Note, you can select a 1, 3 or 6 Month or 1 Year time frame in which to view the data. By sliding the cursor along the horizontal ‘0’ (zero) line on each graph, data for each day will appear.

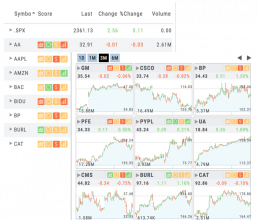

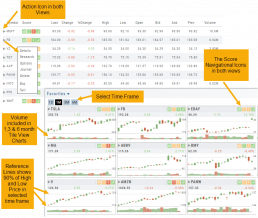

List or Tile View

View any list in traditional List View or Tile View —both show The Score.

Tile View shows thumbnail charts of the entire list. These can be viewed in a variety of periodicies. Volume is included in the 1, 3 & 6 month views to assist with quick analysis. Horizontal Reference Lines show where the Low Price and 90% of the High Price points the stock had for the selected time period.

The Score icons are also navigation shortcuts which will take you directly to Charts, Inner Circle, Valuation or Fundamentals.

Clicking on the Action Icon ![]() next to the Stock symbol in either the List or Tile View will bring up a menu offering additional choices for that Stock.

next to the Stock symbol in either the List or Tile View will bring up a menu offering additional choices for that Stock.

Scans - Find Opportunities - Overview

Stagnant? Uncertain? Bearish or Bullish? Short or long term? No problem!

This “Find” category is where to find opportunities based on current Market activity and outlook, or select opportunities based on events, such as Earnings or Dividend announcements.

Whether looking for opportunities based on The Score, Events, Chart Patterns, Bullish, Bearish, Stagnant or Unknown outlook, a scan will help you find potential trade opportunities.

You can drill-down for scans by Category, Sub-Categories, then Group.

Example: Strategy>Time Spreads>Call Calendar Spreads. You can use the drop-down box, above the Category boxes to search for the scan you want or type in the box a generality about the scan. Examples: “Earning”, “Bull”, “Bearish”. “Score”, “Red”, “Green” will yield scans with that particular name in the scan